Purpose

We equip students with lifelong skills and habits through quality personal finance coursework in order to build economic security.

Definition

Financial literacy is the knowledge, skills, and mindsets needed to make informed and responsible financial decisions, manage money effectively, and build a secure and thriving financial future - for self, family, and community.

Student Experience

Financial Literacy instruction is meant to support students in building the competencies they need in order to make informed and responsible financial decisions in their future. One way to support this is by connecting financial concepts to experiences like work-based learning, postsecondary planning, and other future-oriented opportunities already happening in the school community. These connections help students see how financial decision-making fits into their own lives and long-term goals.

Interactive learning plays a key role in helping students engage with financial literacy in a personal and relevant way. When students have the chance to share their lived experiences and cultural knowledge, learning becomes more meaningful—and less disconnected from what their families know and practice. Many students have shared that they’re learning things in class that feel unfamiliar or inaccessible to their families, which can create tension. To bridge that gap, schools can focus on getting to know their students, involving families in the learning, and creating opportunities rooted in the local community. It’s also important to design instruction with access in mind so that multilingual learners, students with disabilities, and all students can fully participate and connect with the content.Projects, games, and assessments are tools for students to demonstrate their learning in real world situations.

Professional Learning to Impact Students

New Visions for Public Schools will provide implementation support to FRNYC schools through a variety of professional development opportunities. Some supports are mandatory. Review New Visions’ arc of learning and calendar here for further information.

Minimum Experiences FRNYC Schools Must Provide to FRNYC Students:

Starting in SY25-26, schools will be expected to choose at least one cohort of students between 10th and 11th grade to implement up to 54 hours of financial literacy coursework during school hours. While schools may select either grade, 11th grade is preferred to align with developmental readiness, WBL experiences, and post-secondary planning. Schools will utilize one of the following menu of curricula options:

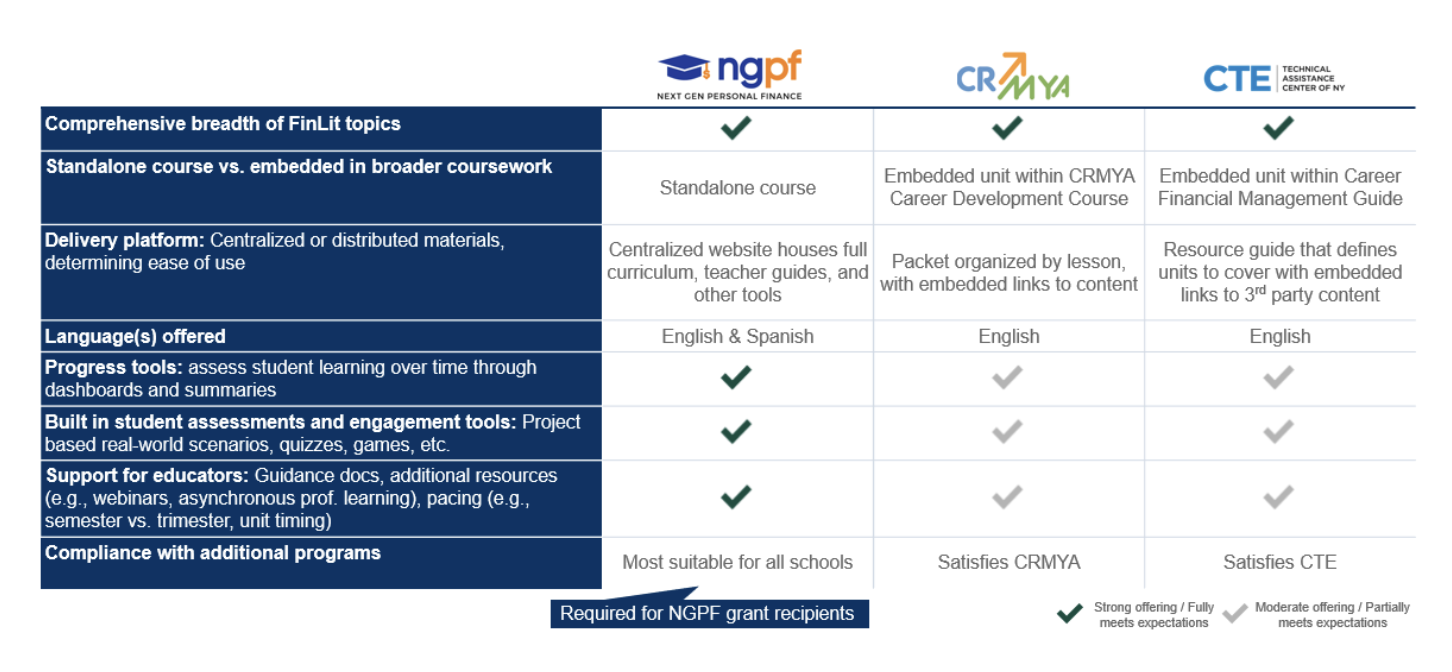

When selecting a curriculum, schools should consider factors such as instructional format, language availability, progress monitoring tools, and alignment with grant or program requirements. The table below compares key features of the financial literacy curricula options:

- Note: Any FRNYC (cohorts 1-4) school that has been accepted into Cohort 3 of the Next Gen Personal Finance Grant has a requirement to offer a stand-alone full semester course using NGPF curriculum, regardless of whether or not you expect to meet your FRNYC FinLit requirements through CFM or Career Development coursework.

- All Schools must schedule and identify financial literacy classroom implementation in STARS utilizing the following:

- Financial Education STARS Wiki (accessed from a networked computer)

- FRNYC Capturing Financial Education Activities in STARS

- For guidance on the number of hours and topics to input in course section properties see the FRNYC STARS Guidance Matrix

- In order to meet these expectations, schools will receive support through professional learning, curriculum resources, FRNYC office hours and Communities of Practice.

- CRMYA and CTE: As per NYSED, NYSED-approved CTE programs may use the CRMYA Career Development course to satisfy CFM. As such, for schools offering both CRMYA and NYSED-approved CTE programs, the CRMYA Career Development course, when used to meet the Career and Financial Management (CFM) requirement, will also satisfy the FRNYC financial literacy expectation for SY25-26. Please note that this expectation may change in SY26-27 as financial literacy coursework continues to be piloted

- CTE: Programs intending to pursue a 7+ credit CTE program sequence may use the Career and Financial Management (CFM) framework/coursework, delivered by a CTE licensed teacher, to satisfy this requirement. FRNYC-CRMYA hybrid schools should continue to use the CRMYA career development curriculum to satisfy this program requirement.

Additional recommended resources

- All Schools can find the Next Gen Personal Finance curriculum here. In order to fully access all NGPF materials and engage in free professional development, educators must sign up for a teacher account. See Directions and Video

- CTE Schools can find the Career and Financial Management (CFM) framework here

- CTE Schools can find the Career and Financial Management (CFM) resource guide here

- CTE Schools can find the CFM/Personal Finance Standards Crosswalk here

- CRMYA schools can find the Career Development Course Materials here